FAQs on the revision of estimate of tax payable in the 11th month of the basis period and the deferment of CP204 and CP500 payments. If the IRB does indeed use the 6 th or 9 th month estimate to calculate the underestimation penalties.

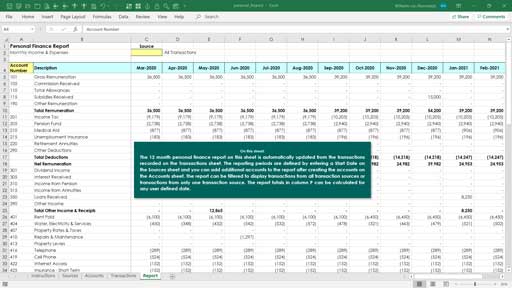

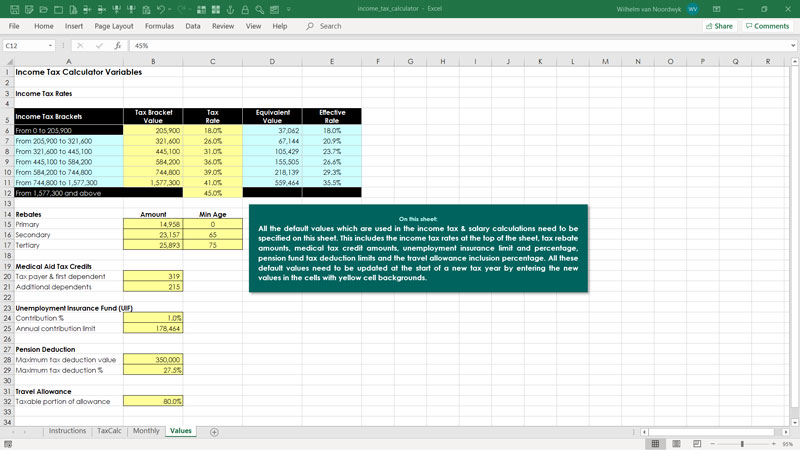

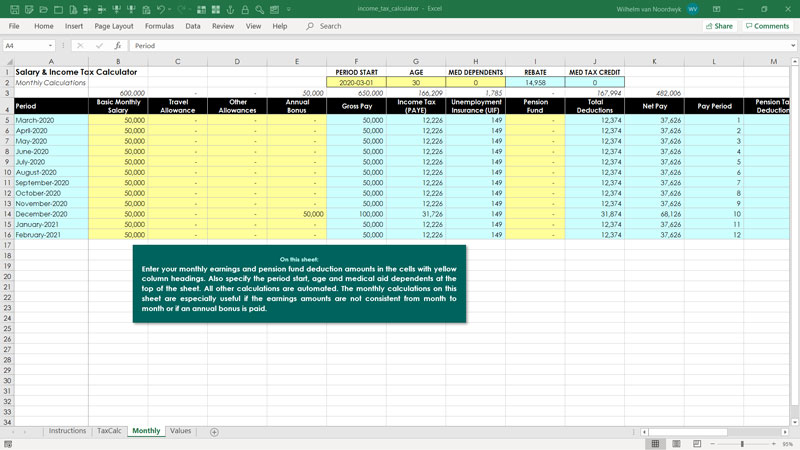

Computation Of Income Tax In Excel Excel Skills

As the initial estimate of tax payable CP204 for YA 2022 andor YA 2023 should have already been.

Tax Calculator Calculator Design Financial Problems Helping People

Tax Calculator Calculator Design Calculator Web Design

Malaysia Taxation Junior Diary 4 Estimation Of Tax Payable Cp 204

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

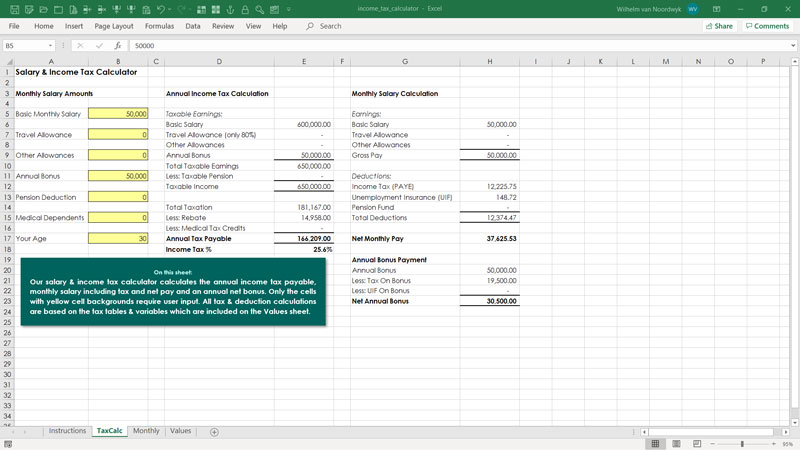

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Computation Of Income Tax In Excel Excel Skills

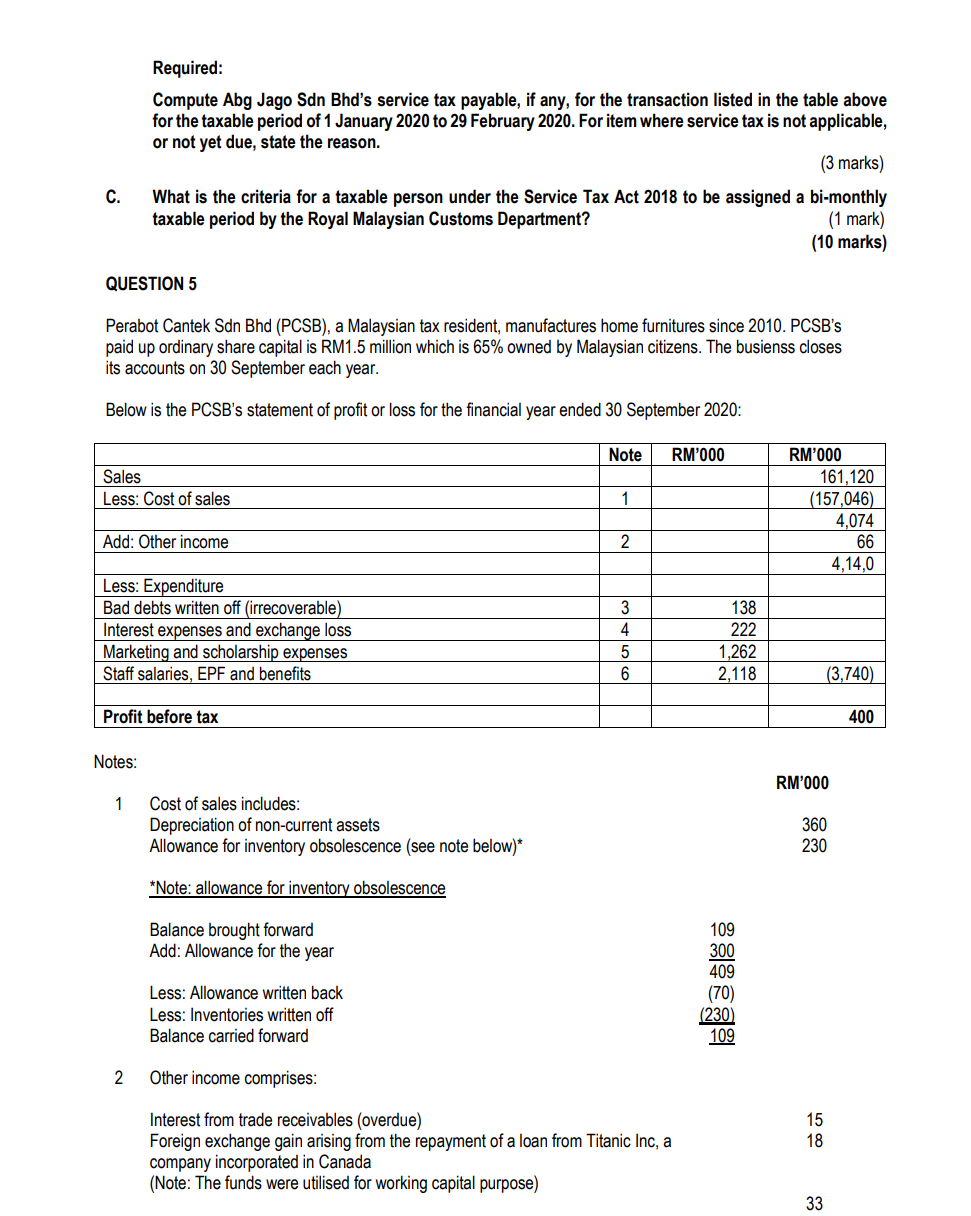

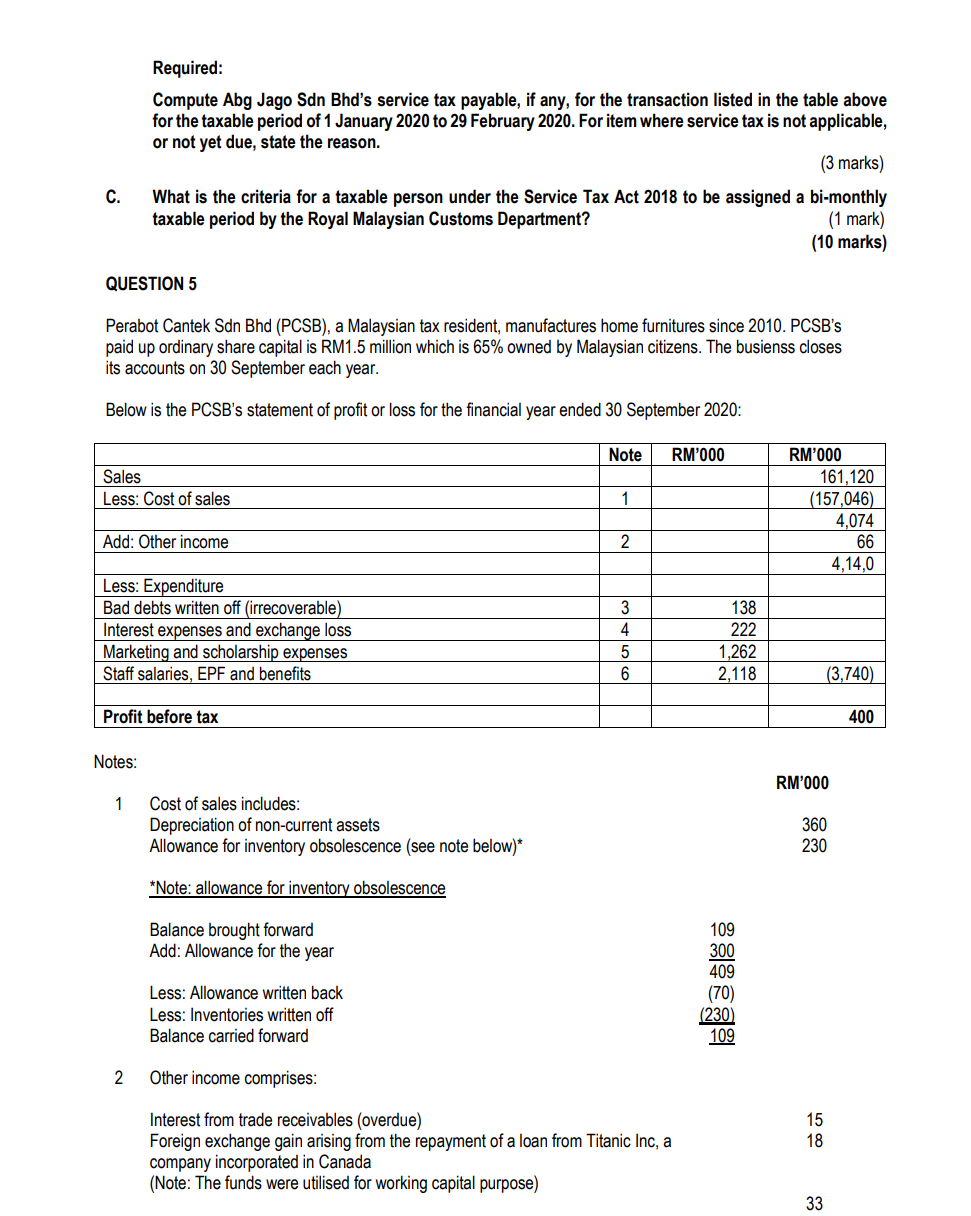

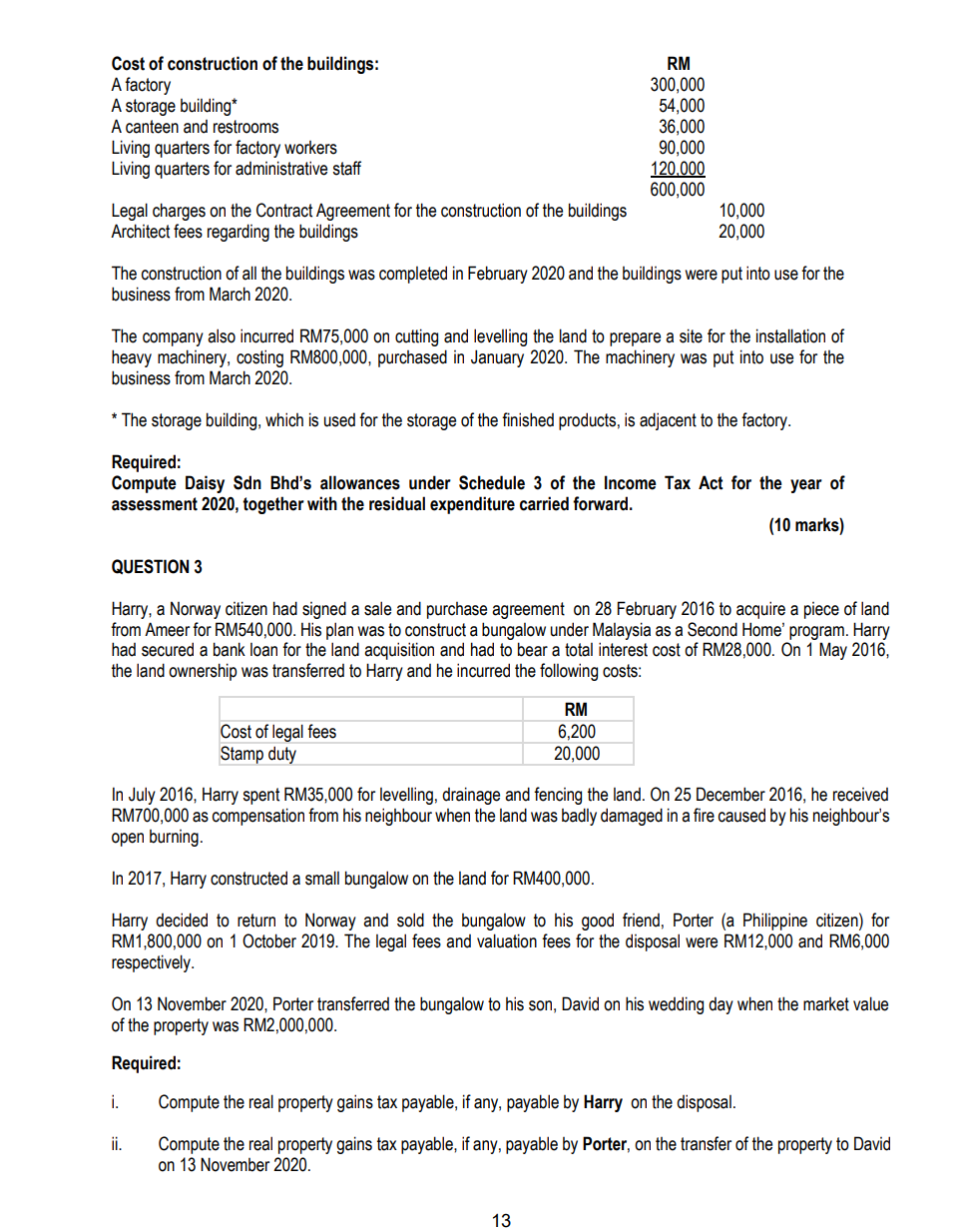

Section B All Six Questions Are Compulsory And Must Chegg Com

What Is Cp 204 How To Pay Cp 204 May 20 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Computation Of Income Tax In Excel Excel Skills

Sales Tax Worksheets Money Math Worksheets Money Math Consumer Math

Section B All Six Questions Are Compulsory And Must Chegg Com

Tax Calculation Spreadsheet Excel Spreadsheets Budget Spreadsheet Spreadsheet

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Computation Of Income Tax In Excel Excel Skills

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Self Employed Tax Calculator Business Tax Self Employment Employment

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Irbm S Guideline On Tax Estimate 3rd Month Revision And Deferment Cheng Co Group

Towards Consultants Services Sdn Bhd Cp 204a I Revised Tax Estimate For Company Ii A Company Can Revise The Tax Estimate On The 6th 9th Month Of The Basis Period